Need a car but worried about bad credit? Buy Here Pay Here (BHPH) dealerships offer in-house financing, helping you get behind the wheel without a traditional credit check. In this article, we’ll explain how BHPH works and its benefits.

Key Takeaways

- Buy Here Pay Here (BHPH) dealerships provide in-house financing options for individuals with poor credit, emphasizing income over credit scores.

- BHPH dealerships offer flexible payment plans tailored to individual financial situations, allowing customers easier access to vehicles without the need for traditional credit checks.

- While BHPH financing has benefits such as quicker approval times, it may come with higher interest rates and limited vehicle selection, making it essential for buyers to conduct thorough research before choosing a dealership.

Understanding Buy Here Pay Here (BHPH) Dealerships

Buy Here Pay Here (BHPH) dealerships are a unique type of car dealership that provide financing directly to consumers through in-house loans. This means that the dealership, rather than a bank or credit union, extends the credit needed to purchase the vehicle. For individuals with poor credit histories who may struggle to obtain financing through traditional means, BHPH dealerships offer a viable solution. Instead of relying solely on credit scores, these dealerships assess a buyer’s income and existing financial obligations to determine financing eligibility.

BHPH dealerships emerged primarily in response to economic hardships in the 1970s. During times of rising unemployment and significant economic transformation, the consumer found it difficult to secure credit. Automobile dealers responded by developing related finance companies (RFCs) to approve loans, allowing them to continue selling vehicles despite the economic downturn. This innovative approach has since evolved, with BHPH dealerships gaining traction during various periods of economic difficulty.

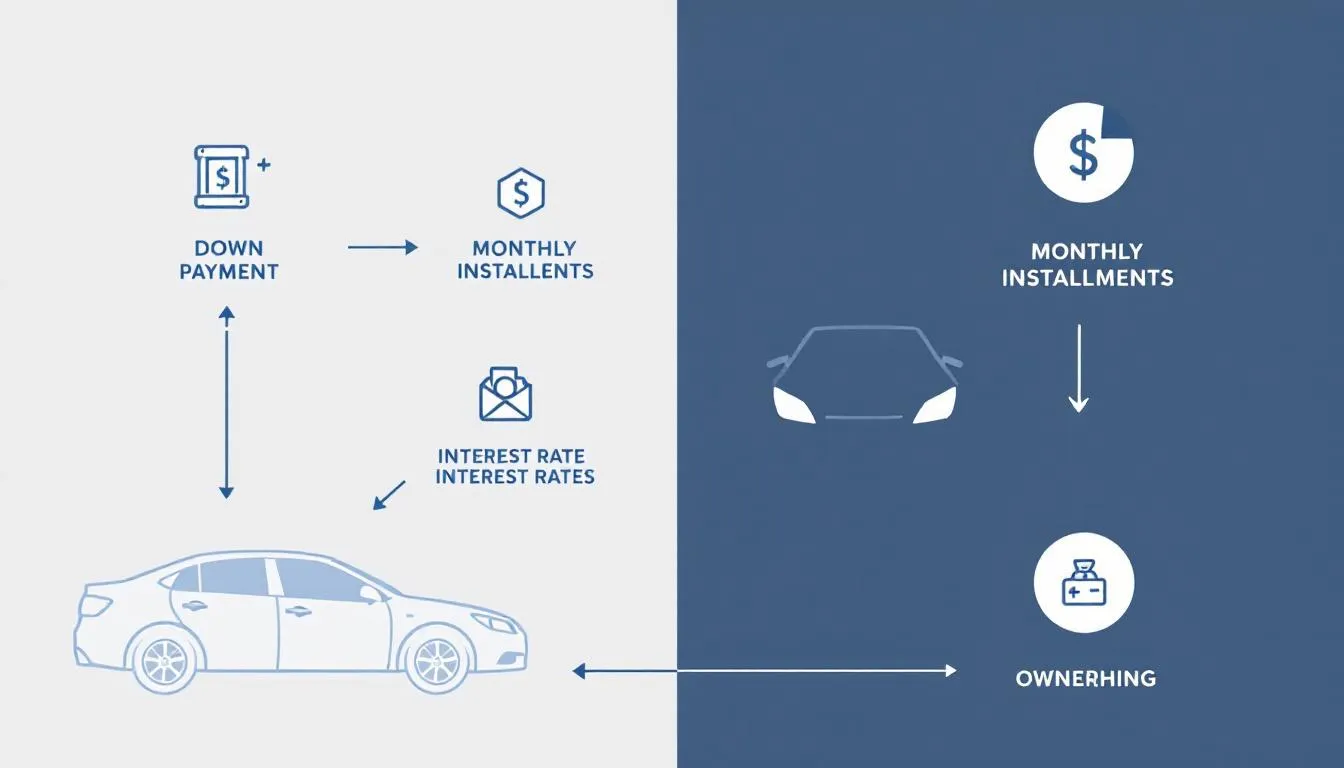

The financing process at BHPH dealerships is designed to be more personalized and accommodating:

- Consumers make payments directly to the dealership rather than through a bank.

- Payments can often be tailored to fit individual financial situations.

- Financing is available without a traditional credit check.

This flexibility makes BHPH dealerships an attractive option for many buyers.

History of Buy Here Pay Here Dealerships

The Buy Here Pay Here (BHPH) industry has its roots in the early 1970s, a time marked by economic difficulties and a challenging credit environment. Rising unemployment and economic transformation made it difficult for many consumers to secure traditional financing, prompting automobile dealers to seek alternative solutions. To address these challenges, dealers began to create related finance companies (RFCs), which allowed them to approve loans in-house and continue selling vehicles despite the economic downturn.

This innovative approach quickly gained traction, especially during periods of economic hardship. By offering a solution to consumers who faced barriers to traditional financing, BHPH dealerships carved out a niche in the auto sales industry. Over the years, these dealerships have evolved to better serve their target audience, providing flexible financing options and accommodating a variety of financial situations.

How Buy Here Pay Here Works

The process at Buy Here Pay Here (BHPH) dealerships is designed to cater to individuals with unique financial circumstances. Unlike traditional lenders that rely heavily on credit scores, BHPH dealerships assess a buyer’s income and existing financial obligations to determine financing eligibility. This approach allows them to serve a broader range of customers, including those with poor credit histories.

To qualify for financing at a BHPH dealership:

- A buyer may need to demonstrate a minimum monthly income, which can be relatively low compared to traditional financing requirements. This makes it easier for individuals with limited income to access vehicle financing.

- Once an application is approved, the buyer can review loan amounts and select a vehicle that fits within their budget.

- Many BHPH dealerships also accept trade-ins as a form of down payment, which can increase the amount a buyer can finance.

Another advantage of BHPH dealerships is their willingness to accommodate lower down payment requirements compared to traditional dealerships. This flexibility allows buyers to get behind the wheel with less upfront money. Additionally, BHPH dealerships often accept older trade-in vehicles, making it easier for buyers to exchange their current cars for a new ride.

Benefits of Buy Here Pay Here Financing

One of the primary benefits of Buy Here Pay Here (BHPH) financing is the flexible payment plans offered by these dealerships. Payments can be tailored to fit the borrower’s financial situation, making it easier to manage monthly obligations. This level of flexibility is often not available through traditional lenders, who may have stricter repayment terms and conditions.

BHPH dealerships also fill a crucial gap in the market by providing financing to individuals with poor credit histories. These dealerships enable consumers to obtain a vehicle without needing a traditional credit check, which can be a significant barrier for those with low credit scores. The financing process at BHPH lots is often quicker and more straightforward compared to conventional dealerships, allowing buyers to get on the road faster.

Another important aspect to consider is that many BHPH dealerships now report payment histories to credit bureaus. This means that making timely payments on a BHPH loan can help improve your credit score over time. By asking whether the dealership reports to credit bureaus, you can understand how your payments might affect your credit, potentially boosting your financial standing for future purchases.

Potential Drawbacks of Buy Here Pay Here Financing

While Buy Here Pay Here (BHPH) financing offers several advantages, there are also potential drawbacks to consider. One of the primary concerns is the higher interest rates charged by these dealerships. Due to the increased risk of lending to individuals with poor credit, BHPH dealerships often charge interest rates around 20% APR, comparable to other subprime loans. This can significantly increase the total cost of the vehicle over the loan term.

Another potential drawback is the limited selection of vehicles available at BHPH lots. Buyers may find their choices restricted, which can be a disadvantage if you’re looking for a specific make or model. Additionally, there is a risk of vehicle repossession if payments are missed. Some BHPH dealerships install tracking devices to facilitate the recovery of vehicles, making it easier for them to repossess the car if you fall behind on payments.

Overall, while BHPH financing can be a lifeline for those with poor credit, it’s essential to weigh these potential downsides carefully. Understanding the higher costs and risks involved will help you make a more informed decision about whether this financing option is right for you.

Regulations Governing Buy Here Pay Here Dealerships

Buy Here Pay Here (BHPH) dealerships operate under a complex web of state laws and regulations that govern their practices. These laws dictate various aspects of the financing process, including interest rates, late fees, and grace periods. For instance, many states set limits on the maximum interest rates that BHPH dealerships can charge consumers, ensuring that these rates remain within a reasonable range.

In addition to interest rate limits, some states require BHPH dealerships to provide specific grace periods before assessing penalties for late payments on a paid date. This regulation helps save protect consumers from immediate financial security penalties if they encounter temporary difficulties in making their payments, pending approval, and are unable to meet their obligations.

The Truth in Lending Act also plays a crucial role in regulating BHPH dealerships by mandating that loan contracts clearly disclose all loan details, including total costs and the cash price of the vehicle, as well as the bill and data. These regulations are designed to protect consumers and ensure transparency in the financing process, which is essential for both the borrower and the lender. This matter is crucial for maintaining trust in financial transactions.

By understanding the legal framework governing BHPH dealerships, you can better navigate the financing options available and make more informed decisions.

Tips for Choosing a Reliable Buy Here Pay Here Dealership

Choosing a reliable Buy Here Pay Here (BHPH) dealership is crucial for a positive car-buying experience. One of the first steps is researching customer reviews online. Consider the following when evaluating dealerships:

- Read about other consumers’ experiences to gain valuable insights into the dealership’s reliability and customer service.

- Look for dealerships with consistently positive reviews.

- Choose dealerships that have a good reputation in the community.

It’s also important to inquire about the dealership’s fees associated with financing. Some dealerships may have hidden costs that can add up quickly, so make sure you understand all the fees involved before finalizing your purchase. Obtaining a vehicle history report is also vital. This report can reveal any past accidents or mechanical issues with the car, helping you make a more informed decision.

Finally, consider the convenience of the payment process. Some BHPH dealerships require payments to be made in person, which can be inconvenient if the dealership is far from your home or work. By taking these factors into account, you can choose a BHPH dealership that meets your needs and ensures a smoother car-buying experience.

Alternatives to Buy Here Pay Here Financing

If Buy Here Pay Here (BHPH) financing doesn’t seem like the right fit, there are several alternatives to consider. Secured personal loans are one option, which require collateral such as a vehicle or house. By offering collateral, you can potentially secure a loan with more favorable terms, even if you have poor credit.

Credit unions are another viable option for obtaining personal loans. These institutions often provide loans with lower interest rates compared to traditional banks, making them a more affordable choice for individuals with poor credit. Additionally, special finance programs designed for individuals with bad credit can offer tailored loan options with flexible payment terms.

Explore these alternatives can help you find a financing solution that best fits your financial situation. Each option has its own set of benefits and drawbacks, so it’s important to carefully consider your needs and circumstances before making a decision.

Common Misconceptions About Buy Here Pay Here

There are several misconceptions about Buy Here Pay Here (BHPH) dealerships that can deter potential buyers. One common myth is that all BHPH dealerships are untrustworthy and exploit consumers. While there are bad actors in any industry, many BHPH dealerships are legitimate businesses focused on helping customers find the right vehicle. It’s essential to research and choose a reputable dealer.

Another misconception is that BHPH dealerships always require large down payments. This is not necessarily true, as many have adapted their business models to accommodate lower down payments, making it easier for consumers to purchase a vehicle. Additionally, some believe that warranties are rare at BHPH dealerships, but many now offer warranties and optional service contracts to protect customers.

Lastly, the practice of rapidly repossessing and reselling vehicles, known as churning, is not representative of the entire BHPH industry. While it is essential to be aware of the risks associated with missed payments, it’s also important to recognize that many BHPH dealerships aim to work with their customers to avoid repossession.

How to Improve Your Credit Score for Better Financing Options

Improving your good credit score can open up better financing options and reduce your reliance on Buy Here Pay Here (BHPH) dealerships. The first step is understanding your current credit score by checking your credit report. Review your fico score for any inaccuracies or fraudulent accounts that could be negatively impacting your score.

Timely payments are the biggest contributor to your credit score. To help improve your score:

- Ensure you pay all your bills on time, including any BHPH loan payments, as these are often reported to credit bureaus.

- Manage credit card debt effectively by paying off balances in full each month.

- If full payment isn’t possible, reduce the balance as much as you can.

Using tools like secured credit cards or credit-builder loans can further assist in building a positive credit history. These financial products are designed for individuals with poor credit and can help demonstrate responsible credit use over time. With dedication and focused effort, substantial improvements in your credit score can start within a few months.

Summary

Buy Here Pay Here (BHPH) dealerships offer a valuable service for individuals with poor credit, providing flexible financing options directly through the dealership. While they emerged in response to economic hardships, they continue to serve a critical role in the auto sales industry. Understanding how BHPH works, the benefits and drawbacks, and the regulations governing these dealerships can help you make an informed decision.

Exploring alternatives to BHPH financing and taking steps to improve your credit score can also open up more favorable financing options. By doing thorough research and considering all available options, you can navigate the car-buying process with confidence and find the best solution for your financial situation.

Frequently Asked Questions

What is a Buy Here Pay Here (BHPH) dealership?

A Buy Here Pay Here (BHPH) dealership offers in-house financing for vehicle purchases, enabling individuals with poor credit histories to buy a car without a standard credit check. This makes it a viable option for those who may struggle to secure financing elsewhere.

How do BHPH dealerships determine financing eligibility?

BHPH dealerships determine financing eligibility by evaluating a buyer’s income and current financial obligations rather than just focusing on credit scores. This approach allows them to offer financing to a broader range of customers.

What are the benefits of BHPH financing?

BHPH financing offers flexible payment plans and a quicker financing process, allowing you to potentially improve your credit score with timely payments. These advantages can make it an appealing option for individuals seeking accessible vehicle financing.

What are the potential drawbacks of BHPH financing?

BHPH financing can lead to higher interest rates, a limited selection of vehicles, and the risk of repossession for missed payments. It’s crucial to weigh these factors before committing to this type of financing.

What are some alternatives to BHPH financing?

Secured personal loans, credit union loans, and specialized finance programs for those with poor credit are effective alternatives to Buy Here Pay Here (BHPH) financing. These options can provide better terms and lower overall costs compared to traditional BHPH agreements.